This page introduces WashU international students and scholars to basic concepts of the U.S. tax system. Most international students and scholars need to file tax documents even if they do not earn income in the U.S. We recommend you read this entire page to understand what requirements apply in your specific situation.

Disclaimer statement

U.S. tax laws are complex and laws that apply to foreign nationals are often different from laws that apply to U.S. citizens or permanent residents. The resources provided on this page may help you better understand your tax obligations, learn where to go for more information and successfully submit your tax forms. For specific questions pertaining to your individual situation and your unique tax obligations, we recommend you contact the IRS, the appropriate state or local government, or a qualified tax professional.

Basic concepts

The U.S. uses a “pay-as-you-go” tax system, meaning taxes are collected gradually throughout the year as you earn income.

Two common ways income tax is paid:

- Tax withholding: This is the most common method. If you work for a U.S. employer (like WashU*), a portion of your tax is automatically deducted from each paycheck and sent directly to the government.

- Estimated payments: If your taxes are not automatically withheld (such as certain stipend income), you may be required to pay taxes quarterly to the government on your own.*

*WashU wage earners or stipend recipients: Find information about Tax Withholdings and Quarterly Estimated Tax Payments on the WashU Financial Services’ website.

Taxpayer IDs: You must have either a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to file a tax return. If you do not have a U.S. taxpayer ID, contact fnis@wustl.edu for assistance.

Filing: After the tax year ends (December 31), you must file your taxes. This process compares the amount you already paid throughout the year against the amount you actually owe, resulting in either a refund or an additional tax payment to the government.

Tax residency status: Foreign nationals in the U.S. can have one of two different tax residency statuses:

- Non-resident alien for tax purposes (NRA)

- Resident alien for tax purposes (RA)

The process to determine tax residency status is the Substantial Presence Test (SPT). If you work for WashU, your tax residency status is determined after you complete FNIS. Also, Sprintax Returns (tax return preparation software) can help determine your tax residency status.

Your tax residency status is NOT the same as your immigration status.

Tax agencies (levels of taxation)

The U.S. tax system operates on three levels, and you may have filing obligations to the federal government and in any state or locality where you lived or earned income.

| Tax Level | Responsible Agency | General Scope |

|---|---|---|

| Federal | Internal Revenue Service (IRS) | Taxes paid to the U.S. federal government |

| State | State Department of Revenue | Applies if you earn income in any state that collects income tax (such as the Missouri Department of Revenue for income earned in Missouri) Filing rules and tax rates vary widely by state |

| Local (City/County) | Local Collector of Revenue | Applies in certain cities or counties that collect local taxes (such as the Collector of Revenue for the City of St. Louis) |

Filing a tax return

Filing a tax return (“filing taxes”) is an annual process due in April. You will compare the taxes you have paid with the total amount you owe and report this information to the government. This process is required for everyone with taxable income.

NRAs

All NRAs must file Form 8843 even if they did not have taxable income. NRAs may also need to file tax return(s) with the applicable tax agency.

NRAs can use Sprintax Returns to prepare and file tax return(s) and Form 8843.

RAs

RAs may consult our tax resources section for guidance on preparing and filing tax return(s).

Tax refund or payment due (the result of filing)

Tax refunds or payments due are calculated by completing your tax return(s). Your tax return(s) will identify the total amount of tax that you were obligated to pay last year. You only pay additional taxes when filing if the amount of tax you owe (your total tax liability).

- Tax refund: If you paid more tax than you owed, you will receive a tax refund.

- Tax payment due: If less tax was paid than you owed, you must pay the remaining balance by the filing deadline.

Types of income subject to U.S. tax

- Wages and salaries from U.S. employment

- Certain taxable stipends, scholarships, or fellowships

For more information, see the WashU Financial Services’ resource page For Fellowship Stipend Recipients. - Other U.S. sourced income (e.g., prizes, awards, or some investment income)

- Additionally, some individuals may be required to pay U.S. on worldwide income (universal income).

What if you have no income to report?

NRAs who did not have taxable income last year, but were in the U.S. for even 1 day last year, must file Form 8843 with the IRS. This requirement applies even if you are not in the U.S. now.

Specific questions about this requirement for RAs should be directed to a tax professional.

What if you are no longer in the U.S.?

RAs and NRAs who had U.S. taxable income last year must file the applicable tax return(s) even if they have left the U.S.

NRAs can use Sprintax Returns from abroad to prepare and file tax return(s).

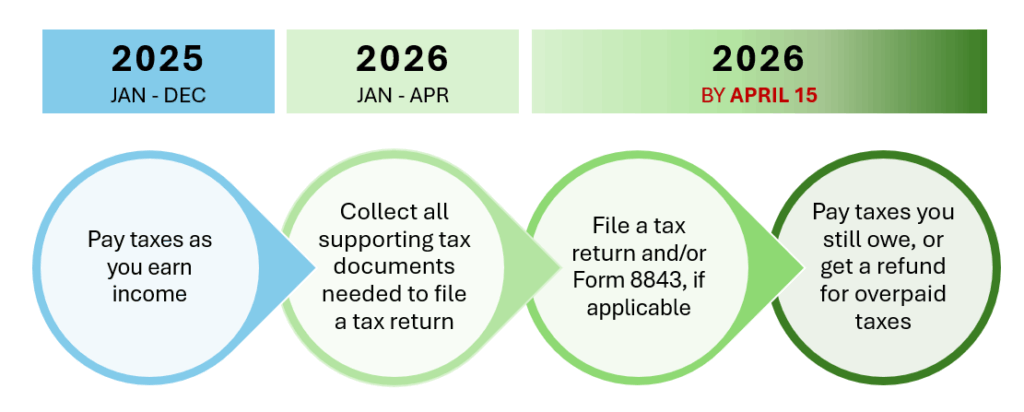

Tax timeline

The U.S. tax year matches the calendar year – it begins on January 1 and ends on December 31.

The tax filing season for a given year begins after the tax year ends (January – April). If you have an obligation to file, the deadline to do so is usually April 15. When April 15 falls on a Saturday or Sunday, the deadline is pushed to the following Monday.

Learn more about the IRS tax filing deadline on their website.

Tax forms

Part 1: Supporting documents (what you receive)

The forms listed below are sent to you by your U.S. employer, financial institution, or university to report income you earned and tax that was withheld. You will need them to complete your final tax return. Be sure you have all your supporting tax documents before filing your final tax return(s). If you file an incomplete tax return, you may need to file an amended tax return after receiving all your supporting tax documents, which may change your tax refund or amount due).

The forms in the table below are some of the most common for foreign nationals, but all, some, or none may apply to you. This is not a comprehensive list of every document you may receive.

| Form | What is this form | Who receives this form | When is the form available |

|---|---|---|---|

| Form W-2 | Wage and Tax Statement | Anyone employed by a U.S. employer (earning a wage) | By January 31 |

| Stipend Letter | Stipend Income | RA stipend recipients who did not claim a tax treaty benefit | By January 31 |

| Form 1042-S | Foreign Person’s U.S. Source Income Subject to Withholding | NRAs who receive certain kinds of income (such as stipends, some fellowship/scholarship income, or payments covered by a tax treaty) | By March 15 |

| Form 1099 Series 1099-INT 1099-MISC | Form 1099 Series includes several different forms (specific form depends on the circumstances) | Individuals who received income not covered by a W-2 or 1042-S (such as certain contract work or interest income) Review the IRS website for each form to learn more | Varies |

See W-2 Form Overview (Workday@WashU) for information on where to find your W-2 and answers to frequently asked questions.

Part 2: Filing forms (what you file)

The forms below are what you complete and submit to the government to calculate your final tax obligation (reconciling the tax you paid throughout the year with what you owe).

| Form | What is the form | Who files this form |

|---|---|---|

| Form 8843 | Statement for Exempt Individuals | All NRAs for tax purposes must file this form (including students, scholars, and their F-2/J-2 dependents) regardless of income The Form 8843 is an informational statement, not an income tax return |

| Form 1040-NR | U.S. Nonresident Alien Tax Return | NRAs for tax purposes who earned taxable income |

| Form 1040 | U.S. Individual Income Tax Return | RAs for tax purposes You are taxed like a U.S. citizen and must report worldwide income |

| State Tax Form (such as MO-1040) | State Individual Tax Return | Individuals with an income tax obligation to a U.S. state (Missouri, or any other state where you lived or earned income) |

Each U.S. state has specific rules and tax forms for reporting income tax (not all use the “1040” designation). If you worked or received taxable income in a state other than Missouri, refer to the specific department of revenue website for that state for more details.

If you work for or receive taxable income from WashU, refer to the WashU Tax Documents page for more details about forms WashU generates for its payees.

Sprintax

WashU partners with Sprintax to help international students and scholars with U.S. tax compliance. Qualifying students and scholars who are NRAs for U.S. tax purposes can use Sprintax Returns as a guided tax preparation software.

RAs for U.S. tax purposes cannot use Sprintax Returns to prepare a tax return.

Any foreign national may use the Sprintax blog, which has helpful information about tax returns, tax residency, tax treaties and many other topics.

Resources

The Internal Revenue Service (IRS) has resources available to help with filing both NRA and RA federal tax returns.

- Main IRS website

- International taxpayers

- Foreign students and scholars

- Nonresident aliens

- Resident aliens for tax purposes

- International taxpayers explanation videos on IRS YouTube page

- Filing options for individuals

- Free File: Do your federal taxes for free

- National IRS Hotline: 800-829-1040

You may also be eligible for assistance from an IRS Taxpayer Assistance Center. Find out how to contact your local office and make an appointment.

The Missouri Department of Revenue has resources available to help you file your Missouri state tax return. Remember, your state tax return is different from the federal tax return.

The Volunteer Income Tax Assistance (VITA) program offers free tax help to people who generally make $67,000 or less, persons with disabilities, and limited English-speaking taxpayers who need assistance in preparing their own tax returns. IRS-certified volunteers provide free basic income tax return preparation with free electronic filing to qualified individuals.

You can find VITA sites near you on the IRS website at Free tax return preparation for qualifying taxpayers.

If you are unable to file taxes or are uncomfortable using the resources listed here, you may want to hire an accountant who understands international taxation. Search for an accountant on one of the following online directories:

- Missouri Society of Accountants

- National Association of Enrolled Agents

- Better Business Bureau (BBB) list of tax return preparation agencies near St. Louis

If you hire an accountant, ask questions to determine if they understand international taxation and nonresident taxes. Be sure to ask about tax treaties, nonresident alien exemptions, and deductions on tax returns.

Resident Aliens (RAs) cannot use Sprintax Returns to file a tax return, but there are other software options available, such as TurboTax and H&R Block. Please research your options online to find a program that will be suitable for your needs, or speak with a tax professional for personal assistance.

Beware of scams

The Internal Revenue Service (IRS) initiates most contact through regular mail delivered by the United States Postal Service (USPS). Be suspicious of communication claiming to be from the IRS received via email, text message or social media.

Do not open electronic communication from someone who claims to represent the IRS. It likely contains a virus or malware. Never provide your SSN or ITIN to anyone through email, text message or social media.

Scams take many shapes and forms, such as phone calls, letters and emails. Many IRS impersonators use threats to intimidate and bully people into paying a fake tax bill. They may even threaten to arrest or deport someone if they don’t comply. The IRS also provides a webpage on how to recognize tax scams and fraud.

How To Report Scams – Taxpayers can use these options to report phone, email and other impersonation scams:

- Report impersonation scams to the Treasury Inspector General for Tax Administration on the IRS Impersonation Scam Reporting webpage. Taxpayers can also call 800-366-4484 to report impersonation scams.

- Report phone scams to the Federal Trade Commission. Add “IRS Telephone Scam” in the notes.

- Report unsolicited emails claiming to be from the IRS or an IRS-related system like the Electronic Federal Tax Payment System to the IRS at phishing@irs.gov.

- For a comprehensive listing of recent tax scams, consumer alerts and how to report them, visit Tax Scams/Consumer Alerts.